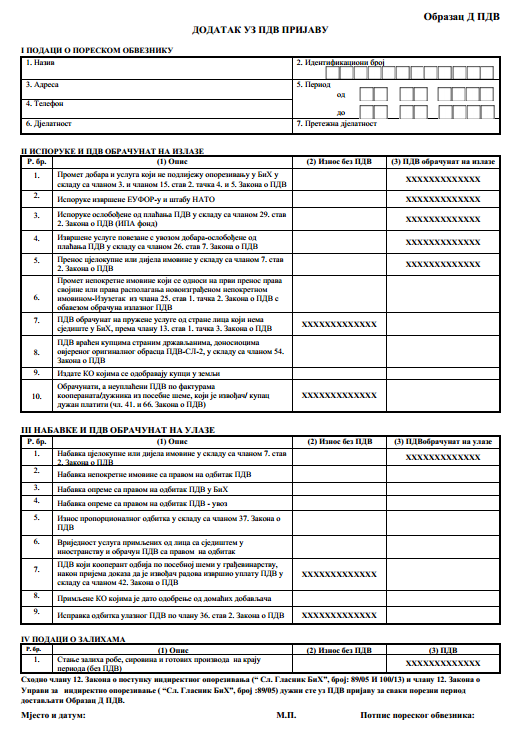

(23.04.2014.) - Obligation of submitting the Appendix to the VAT Report

On the website of the Indirect Taxation Authority was published the news of the obligation of submitting of Form D PDV, by which shall terminate the obligation of submitting explanations of negative field 71 of VAT report.

The form has twenty fields that need to be filled in case of fulfillment of the conditions specified in them, and which are splitted into three groups (delivery and VAT calculated on output, procurement and VAT calculated on inputs and stock src).

In addition to the form, the ITA website has published explanations for completing the appendix of the VAT report.

Obligation of submitting appendix to the VAT report begins with the day of submission of regular VAT report for the April in 2014. year.

Form D PDV is available via the link:

and explanations for completing the appendix of the VAT report via the link:

http://www.uino.gov.ba/download/2014/Dokumenta/Sr/OBJASNJENJE%20ZA%20POPUNJAVANJE%20D%20PDV%20SR.pdf.